tax lien nj sales

State of New Jersey. 2021 DATES TO REMEMBER DURING THE TAX SALE PROCESS Wednesday November 10th Last day to.

Due to changes in the New Jersey State Tax Sale Law the tax collector must create the tax sale list 50 days prior to the sale and all charges on that list together with cost of sale must be paid.

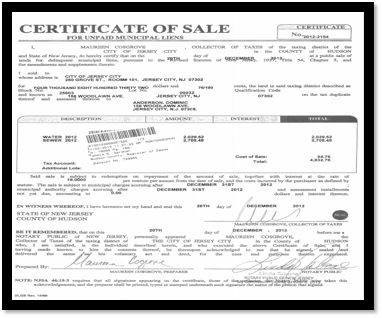

. What is sold is a tax sale. 2022 Tax Lien Sale - October 27 2022. New Jersey liens are documents that serve a legal security for a loan.

According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax. 2021 Online Accelerated Tax Lien Sale December 17. Map More Homes in Cherry Hill.

The tax collector is required by state law to hold a tax sale each year for the prior years unpaid municipal charges. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. Its the end of the year and the holiday season and one of the busiest months for tax sales in New Jersey.

Village of rochester - 176-031914026000. For a listing of all. 1000 AM - 1033 Weldon Rd Lake Hopatcong NJ.

Tax sale liens are obtained through a bidding process. Of the 20th day of the month after the end of the filing. Sales and Use Tax Online Filing and Payments.

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. The City of Trenton announces the tax sale of 2019 2nd quarter and prior year delinquent taxes and other municipal charges through an online auction. River n rd residential lot - aprox.

Cherry Hill NJ 08003. Learn the components of liens in New Jersey the relevance of liens how to enforce a lien and collect a judgment the. Quarterly Sales and Use Tax Returns are due before 1159 pm.

Any interested parties please send a self-addressed stamped envelope requesting for a tax sale list when it becomes available to. There are currently 139543 tax lien-related investment opportunities in New Jersey including tax lien foreclosure properties that are either available for sale or worth pursuing. If you do not pay your property taxes a lien will be sold against the.

Why is now a good time for tax lien sales in New Jersey. Village of rochester - 176-031918160000.

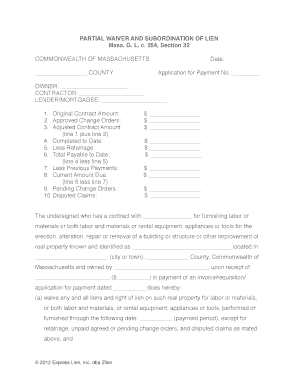

Bill Of Sale Form New Jersey Lien Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

The Official Website Of City Of Union City Nj Tax Department

Otc Tax Liens How We Made 6 In Less Than 120 Days With Tax Liens

![]()

Tax Sales Tax Collectors Treasurers Association Of Nj

A Crash Course In Tax Lien Deed Investing And My Love Hate Relationship With Both Retipster

New Jersey Tax Lien Auction Pre Sale Review Florence Nj Online Sale Youtube

Investors Plead Guilty In Nj Tax Lien Probe Nj Spotlight News

Special Seminar On Tax Lien Investing In New Jersey

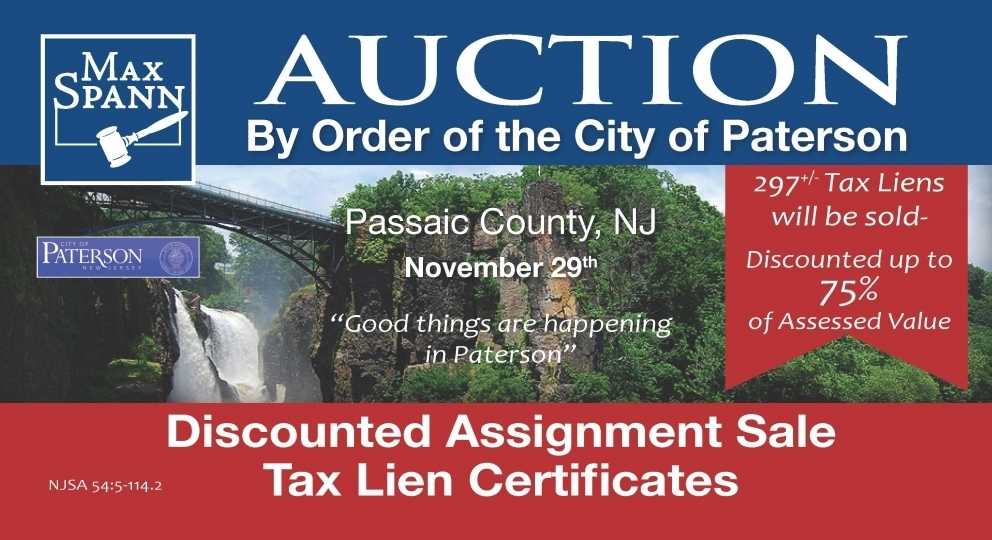

Special Tax Lien Assignment Sale Paterson Nj

November Tax Lien Sale Canceled Hopewell Borough

New Jersey Real Estate Tax Foreclosure Attorneys

Deerfield Township Cumberland New Jersey Tax Lien Sale Information

More Than 400 Listings In West Orange 2022 Tax Lien Sale West Orange Nj Patch

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Brick Sets Tax Lien Sale For April 19 Brick Nj Patch

Paterson Nj Facing Deficit As High As 12 Million After Tax Lien Sale

297 Tax Liens Will Be Sold Discounted Up To 75 Of Assessed Value In Paterson Nj